Applied Materials (NASDAQ:AMAT) stock gained over 12% in yesterday’s extended trading session. The upside can be attributed to better-than-expected results for the fiscal first quarter and upbeat Q2 guidance provided by the company.

AMAT supplies equipment, services, and software used in the manufacturing of semiconductor chips.

Q1 Report in Detail

The company reported adjusted earnings of $2.14 per share in Q1, up 4.9% year-over-year. Also, it came above the consensus estimate of $1.90. Meanwhile, net revenue decreased marginally to $6.71 billion from $6.74 billion in the year-ago quarter but surpassed the Street’s expectations of $6.48 billion.

It is worth mentioning that China emerged as a significant growth driver, with revenues surging by 162% year-over-year and accounting for about 45% of the company’s total revenue. Also, revenue from Japan increased by 23.9%. The rise in revenue from these two regions partly offset the decline in sales in the U.S., Taiwan, and Europe.

Q2 Outlook

Applied Material’s performance is expected to benefit from a rise in investments by semiconductor companies in new production capacity due to the increasing demand for artificial intelligence (AI) chips.

The company expects to report adjusted earnings between $1.79 and $2.15 per share, compared with the consensus estimates of $1.80. Additionally, AMAT expects revenues to come in the range of $6.1 billion and $6.9 billion. The analysts are expecting sales of $6.34 billion.

What Is the Price Target for AMAT?

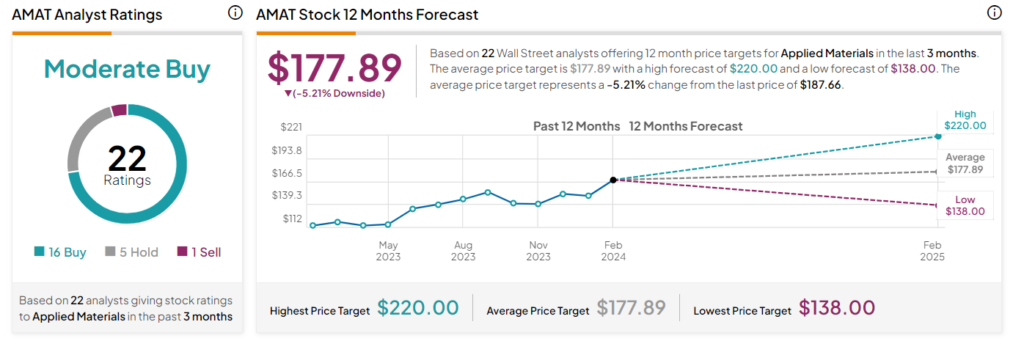

Overall, Wall Street analysts are currently sidelined on AMAT stock with a Moderate Buy consensus rating based on 16 Buys, five Holds, and one Sell assigned in the past three months. The average price target of $177.89 implies a 5.1% downside potential.