E-commerce giant Amazon (NASDAQ:AMZN) and transportation, e-commerce, and business services provider FedEx (NYSE:FDX) explored opportunities to work together again, the Wall Street Journal reported. However, the discussions between Amazon and FedEx didn’t materialize.

The discussion between the two companies revolved around the possibility of FedEx facilitating the return process for Amazon packages at its retail outlets. It is noteworthy that FedEx and Amazon went their separate ways in 2019 following FedEx’s termination of their ground delivery contract. Meanwhile, Amazon has since forged partnerships with various firms, including FedEx’s competitor, United Parcel Service (NYSE:UPS), to manage its returns. AMZN has also made significant investments in developing its own logistics capabilities.

While the deal failed to materialize, a partnership between Amazon and FedEx would have been mutually beneficial. It could have bolstered FedEx’s revenue streams while enhancing Amazon’s customer experience in return processing. With this backdrop, let’s look at what the Street recommends for AMZN and FDX stocks.

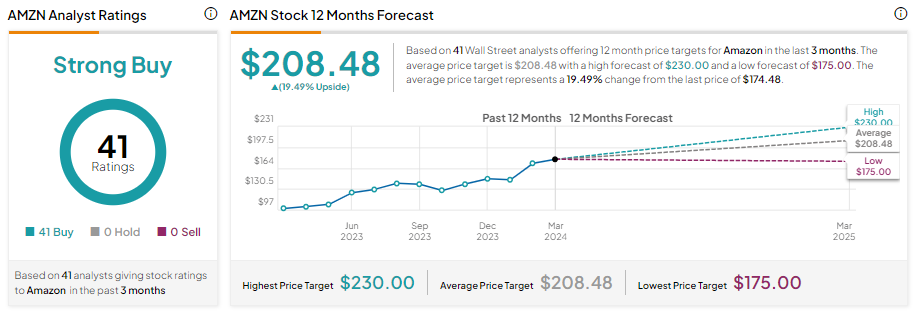

Is Amazon a Buy or Sell?

Amazon stock has gained about 79% in one year. The company focuses on improving delivery speed and customers’ shopping experiences on its platform. Additionally, its initiatives to drastically reduce costs, ongoing strength in the cloud business, aggressive investments in Artificial Intelligence (AI) advancements, and focus on generating sustainable earnings are positives.

Wall Street analysts maintain a bullish outlook about Amazon stock. Notably, 41 analysts cover Amazon, and all recommend a Buy. Analysts’ average price target on AMZN stock is 208.48, implying 19.49% upside potential over the next 12 months.

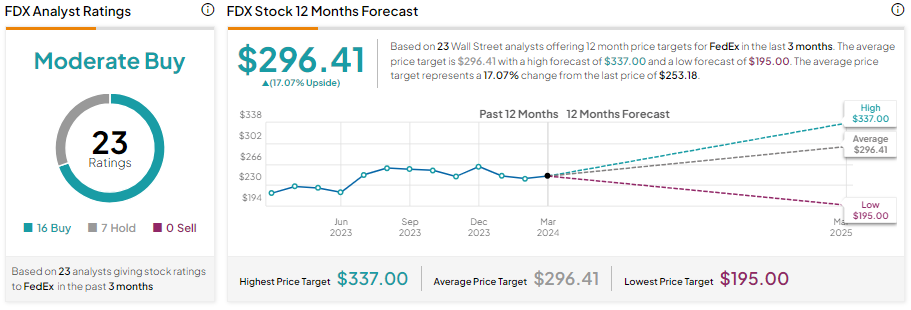

Is FedEx a Buy, Sell, or Hold?

FedEx stock is up about 19.5% in one year, reflecting the company’s efforts to reduce costs through the DRIVE program and its global transformation plan to improve its long-term profitability. However, adverse weather conditions and macro weaknesses remain a drag.

With 16 buy and seven Hold recommendations, FedEx has a Moderate Buy consensus rating. Analysts’ average price target on FDX stock is 296.41, implying 17.07% upside potential from current levels.