Altice USA (NYSE:ATUS) shares jumped by over 8% in the early session today after the broadband and video services provider announced its results for the fourth quarter. Despite a year-over-year decline of 2.9%, revenue of $2.3 billion came in better than expectations by a thin margin of $10 million. Net loss per share of $0.26, however, missed the cut by $0.32.

During the quarter, Residential revenue declined by 2.8% to $1.79 billion due to the loss of higher ARPU (Average Revenue Per User) customers. At the same time, its Residential ARPU improved by $0.15 to $136.01 for the quarter. In Business Services, revenue inched up by 1% to $372 million. While overall News and Advertising revenue declined by 15.7%, excluding the impact of political advertising, the segment clocked 8.9% gains.

Despite these declines, Altice’s Q4 was marked by improving trends in its top line and adjusted EBITDA. In Q4, its adjusted EBITDA declined by 1.1% versus a 12.4% drop in Q1. Further, its operating free cash flow came in at a healthy $608 million for the quarter. The company increased its number of Fiber customers by over 46,000 to 341,000. Importantly, the penetration of its Fiber network improved to 12.5% from 8% in the year-ago period.

Is ATUS a Good Investment?

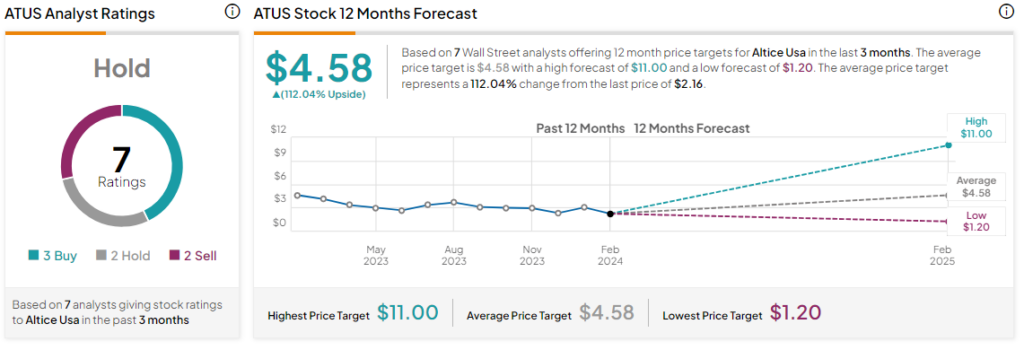

Today’s price gains come after a nearly 52% decline in the company’s share price over the past year. Overall, the Street has a Hold consensus rating on Altice, and the average ATUS price target of $4.58 points to an eye-popping 112% potential upside in the stock.

Read full Disclosure