Alibaba’s (NYSE:BABA) calendar Q4 results were a mixed bag. The Chinese e-commerce major posted revenues of $36.6 billion or RMB260.35 billion, up by 5% year-over-year. However, this fell short of analysts’ estimates of RMB262.1 billion. On the other hand, the company reported adjusted earnings of RMB18.97 or $2.67 per American Depository Share (ADS), which beat consensus estimates of $2.66 per share.

The company expanded its stock buyback program by $25 billion until the end of March 2027, bringing the total buyback available under this program to $35.3 billion.

Alibaba is increasingly focusing on the e-commerce and cloud computing businesses for growth. The company’s e-commerce businesses, Taobao and Tmall, saw revenues of RMB129.1 billion in the December quarter, up just 2% year-on-year. Meanwhile, its cloud computing business generated sales of RMB28.1 billion, a 3% rise year-over-year.

Is BABA a Buy, Sell, or Hold?

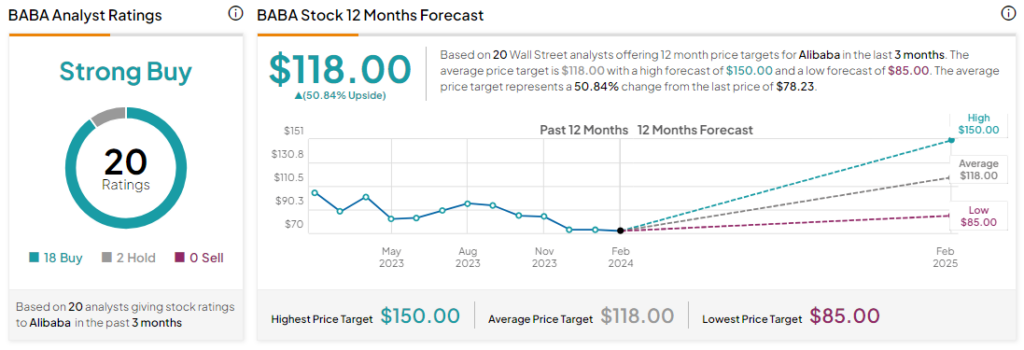

Analysts remain bullish about BABA stock with a Strong Buy consensus rating based on 18 Buys and two Holds. Over the past year, BABA stock has dropped by more than 20%, and the average BABA price target of $118 implies an upside potential of 50.8% at current levels.