The 5 Best Renewable Energy stocks to buy in March 2024 have gained highly optimistic views from Wall Street analysts. The growing focus and adoption of renewable energy sources and decarbonization targets worldwide are leading to a wave of newer renewable energy players. Traditional energy sources such as coal, gas, oil, and nuclear energy are causing heavy environmental changes that are hampering the quality of life.

Some examples of renewable energy sources are solar, wind, hydro, biomass energy, geothermal, and marine energy. Companies that explore, produce, and adopt these energy sources are expected to be the winners in the long run since even the governments are supporting the growth of the sector. As per stats from Polaris Market Research, the Global Renewable Energy market stood at $1,056.27 billion in 2023 and is expected to grow at a CAGR of 8.6% through 2032.

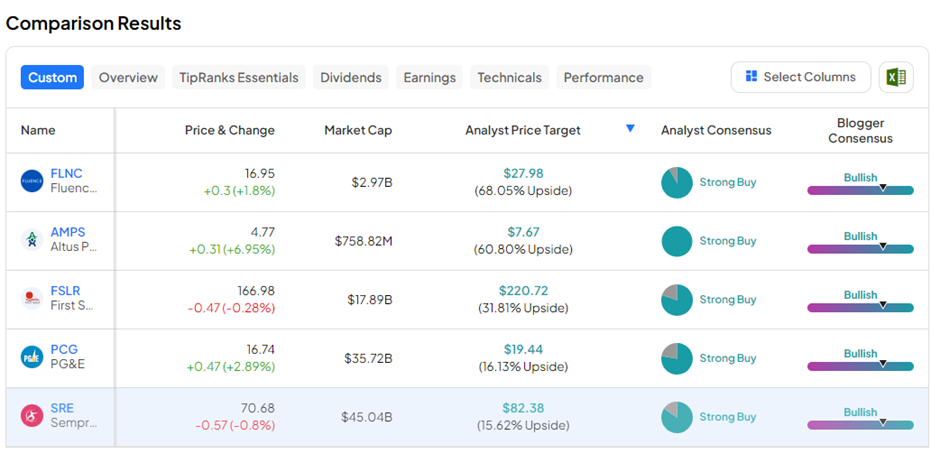

With this background in mind, let us understand the nature and scope of the 5 Best Renewable Energy Companies, as per Wall Street analysts.

#1 Fluence Energy (NASDAQ:FLNC)

Fluence Energy is on a mission to enable the global clean energy transition with energy storage products and services and cloud-based software (digital applications) for renewables and energy storage. Fluence was formed by industry stalwarts Siemens (DE:SIE) and AES Corp. (NYSE:AES) in 2018.

In its Q1 FY24 results, revenues jumped 17% year-over-year while net loss lowered to $25.56 million from $37.19 million reported a year earlier. The company also recorded an all-time high order intake of $1.1 billion.

For Fiscal 2024, FLNC expects revenue in the range of $2.7 billion to $3.3 billion and annual recurring revenue (ARR) of roughly $80 million. Importantly, FLNC is expecting to start its own battery module manufacturing, with domestic content at the Utah site in the summer, which will enhance its competitive position and benefit both the company and its customers under the Inflation Reduction Act (IRA) of 2022.

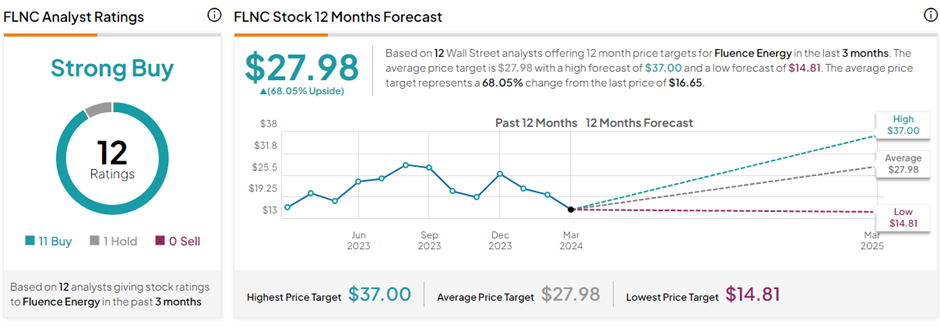

Is FLNC a Good Stock?

With 11 Buys versus one Hold rating, FLNC stock has a Strong Buy consensus rating on TipRanks. The average Fluence Energy price target of $27.98 implies 68.1% upside potential from current levels.

#2 Altus Power Inc. (NYSE:AMPS)

Altus Power offers clean energy solutions to enterprises, schools, hospitals, nonprofit entities, and municipalities. Its offerings range from on-site solar generation for commercial, industrial, and public customers to community solar, energy storage, and EV (electric vehicle) charging.

In Fiscal 2023, Altus Power’s revenues soared 53%, while adjusted EBITDA (earnings before interest, tax, depreciation, and amortization) improved 59% from the previous year. This growth was backed by record customer additions and growth in megawatt hours sold during the year.

For Fiscal 2024, AMPS projects revenues to be between $200 and $222 million and adjusted EBITDA in the range of $115 to $135 million.

Is Altus Power a Buy?

On TipRanks, AMPS stock commands a Strong Buy consensus rating based on three unanimous Buys. The average Altus Power price target of $7.67 implies 60.8% upside potential from current levels.

#3 First Solar, Inc. (NASDAQ:FSLR)

One of the better-known stocks in the solar power realm, First Solar is one of the largest manufacturers of solar panels and thin film photovoltaic (PV) solar modules. FSLR’s panels are designed with cadmium telluride solar modules, which offer high efficiency at a lower cost compared to traditional PV panels.

With the intention to complete five fully committed solar manufacturing sites by 2025, the company is targeting an annual manufacturing capacity of over 20 gigawatts (GW) across the U.S., India, Malaysia, and Vietnam.

In its latest results, First Solar reported a 26.7% increase in revenues for 2023, and a net profit of $7.74 per share compared to a loss of $0.41 per share in the prior year.

For Fiscal 2024, FSLR forecasts revenue between $4.4 billion and $4.6 billion and EPS in the range of $13 and $14.

Is FSLR Stock a Good Buy?

With 16 Buys and four Hold ratings, FSLR stock has a Strong Buy consensus rating on TipRanks. The average First Solar price target of $220.72 implies 31.8% upside potential from current levels.

#4 PG&E Corp. (NYSE:PCG)

Next on the list is PG&E Corp, which operates through its subsidiary Pacific Gas & Electric Corporation. The company provides natural gas and electric service to residential and business customers in northern and central California. PG&E generates electricity using nuclear, hydroelectric, fossil fuel, fuel cell, and PV sources.

In Fiscal 2023, PG&E met the high end of its guidance by reaching adjusted EPS of $1.23, significantly increasing from $1.10 in the prior year. At the same time, operating revenues for the full year jumped 12.7% to $24.43 billion.

Also, the company boosted its FY24 adjusted EPS guidance to the range of $1.33 to $1.37 from the prior outlook range of $1.31 to $1.35, thanks to the continued business momentum.

Is PG&E Stock a Good Buy?

On TipRanks, PCG stock has a Strong Buy consensus rating based on seven Buys and two Hold ratings. The average PG&E price target of $19.44 implies 16.1% upside potential from current levels.

#5 Sempra Energy (NYSE:SRE)

Sempra Energy is an energy infrastructure company that engages in the sale, distribution, storage, and transportation of electricity and natural gas. Sempra serves roughly 40 million customers and claims to be well-positioned to benefit from the global energy transition. Given its focus on energy transition, Sempra is making investments in three key capabilities: decarbonization, diversification, and digitalization.

For Fiscal 2023, Sempra reported adjusted EPS of $4.61, the same as in the prior year period, while revenue increased 15.8% to $16.7 billion. For Fiscal 2024, Sempra narrowed its full-year EPS guidance to be between $4.60 and $4.90.

Meanwhile, Sempra raised its annualized common stock dividend by 4% to $2.48 per share, marking the 14th consecutive year of a dividend hike.

Is Sempra Energy a Good Stock to Buy?

With nine Buys versus one Hold rating, SRE stock has a Strong Buy consensus rating on TipRanks. The average Sempra Energy price target of $82.61 implies 15.9% upside potential from current levels.

Ending Thoughts

The renewable energy sector is poised for solid growth in the long run as reliance on cleaner energy sources increases. Some of the positive catalysts for the sector include declining costs of renewable energy, favorable government policy and regulations, and improving infrastructure. All these, combined with reduced greenhouse gas emissions, seem to be a very positive motive to invest in renewable energy companies. The above five companies are poised to benefit from the energy transition and could be considered by investors after thorough research.