These are the 5 Best AI (artificial intelligence) stocks to buy in April 2024, according to Wall Street analysts. The AI domain, which gained profound importance in 2023 with the advent of OpenAI’s ChatGPT, has jumped to the next level with almost all tech companies and chip makers trying to gain an upper hand in the sector. Rest assured, AI is going to remain a hot topic for 2024 and beyond as newer advancements in the AI field produce unthinkable apps and bots.

We have sorted 5 best AI stocks that are already frontrunners in the AI race and are here to stay as long-term potential beneficiaries of the technology, as per analysts.

#1 Nvidia (NASDAQ:NVDA)

It is nearly impossible to exclude Nvidia from the list of best AI stocks. The GPU (graphics processing unit) maker is one of the most important players in the AI space with applications in gaming, machine learning, video editing, and content creation. Its high-quality GPUs are used to accelerate the pace of generative AI apps in all domains including the cloud, data centers, network edge, and embedded devices.

Remarkably, NVDA stock has gained 224% in the past year, making it the top performer in the AI space. The company trades at a high P/E (price-earnings per share) of 75.7x, which is justified by the top-notch earnings generated by the company. In Fiscal 2024, revenues jumped 126%, while adjusted earnings per share (EPS) skyrocketed 288% compared to the prior year, demonstrating Nvidia’s capability to deliver solid returns for its shareholders.

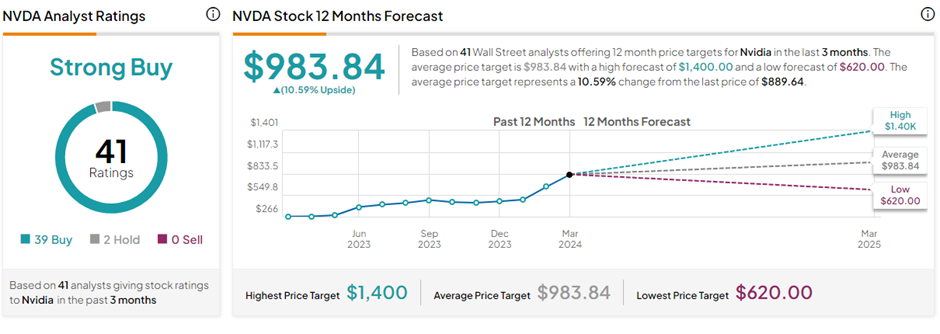

What is the Price Target for NVDA?

On TipRanks, the average Nvidia price target of $983.84 implies 10.6% upside potential from current levels. Also, NVDA stock has a Strong Buy consensus rating backed by 39 Buys versus two Hold ratings.

#2 Advanced Micro Devices (NASDAQ:AMD)

Next up is Advanced Micro Devices, a fabless semiconductor designer known for its next-gen semiconductors and chips. AMD’s chips are significantly used in cloud computing and AI space. The company is expected to give tough competition to Nvidia’s chips in the days ahead, given the huge potential of its MI300X accelerator. AMD offers a wide range of adaptive hardware and software solutions that enable AI in almost every industry.

AMD stock has gained 88.6% in the past year. For its Q1 FY24 results scheduled on April 30, the Street expects AMD to post adjusted earnings of $0.61 per share on revenues of $5.46 billion (mostly in line with AMD’s guidance). The figures do not reflect a jump over the prior year’s numbers and the stock also trades at a high P/E of 341.5x. Despite these shortcomings, analysts remain bullish about AMD’s long-term stock trajectory as the chip maker is picking up pace in the AI race.

Is AMD a Buy or Sell Today?

AMD stock has a Strong Buy consensus rating based on 28 Buys and six Hold ratings on TipRanks. The average Advanced Micro Devices price target of $201.26 implies 11.3% upside potential from current levels.

#3 Meta Platforms (NASDAQ:META)

Meta Platforms is known as the social media giant attracting billions of monthly active users on its apps. The company continues to draw higher revenues and earnings power from these apps. The maker of Facebook, Instagram, and WhatsApp is leveraging AI in every app to help advertisers reach their targeted audiences effectively. The company also has huge ambitions in the Virtual Reality (VR) space.

Interestingly, Meta’s Llama 2 model is an open-source large language model (LLM) pre-trained on a range of 7 billion to 65 billion parameters for producing the most accurate generative AI responses. The company is reportedly set to release the latest version of AI LLM, Llama 3, in July this year. Llama 3 is expected to deliver better answers to contentious questions. The Street expects Meta to report diluted earnings of $4.29 per share on revenues of $36.05 billion in Q1 FY24, showing huge growth compared to the prior year. In the past year, META stock has grown by 136%.

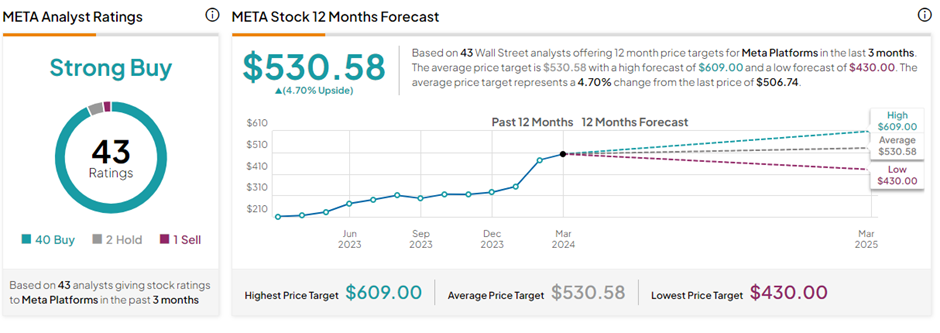

Is Meta a Good Stock to Buy?

With 40 Buys, two Holds, and one Sell recommendation on TipRanks, META stock has a Strong Buy consensus rating. The average Meta Platforms price target of $530.58 implies 4.7% upside potential from current levels.

#4 ServiceNow (NYSE:NOW)

ServiceNow is an enterprise cloud computing platform. The company has integrated AI massively in all its computing solutions to enable automation in the IT service, field service, customer service, and human resources teams. Now Assist is the company’s digital copilot that can also help developers build products efficiently by turning natural language into computer code.

NOW stock has gained nearly 60% in the past year, thanks to its fast-paced innovations, solid subscriber revenue growth (99% renewal rate), and robust fundamentals. NOW stock has a P/E of 90.6x, which is reasonable for a company poised for superior growth in the coming years. For Q1 FY24, the consensus for adjusted earnings is pegged at $3.15 per share on revenues of $2.59 billion, attributing huge growth potential.

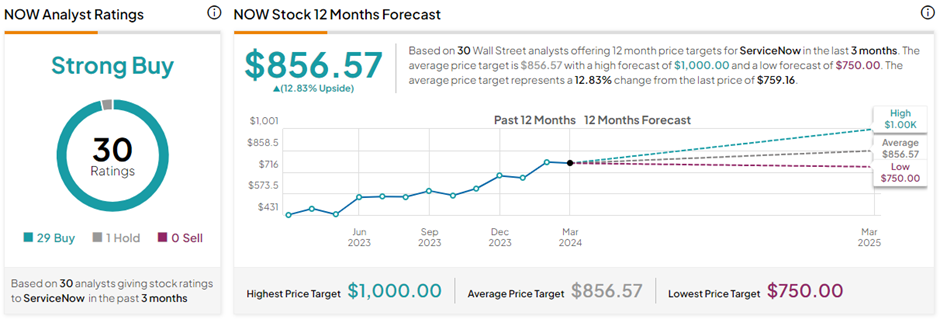

Is ServiceNow a Buy or Sell?

NOW stock commands a Strong Buy consensus rating on TipRanks, backed by 29 Buys and one Hold rating. The average ServiceNow price target of $856.57 implies 12.8% upside potential from current levels.

#5 Symbotic (NASDAQ:SYM)

Symbotic is a relatively smaller company compared to the aforementioned companies but with huge potential to grow in the AI space. It builds and operates robotic automated warehouses across North America. The company’s leading clients include some of the big names in the retail space such as Target (NYSE:TGT), Walmart (NYSE:WMT), Albertsons (NYSE:ACI), C&S Wholesale Grocers, and Giant Tiger. Symbotic’s AI-powered software enables the smooth functioning of warehouses, driven by machine learning, digitization of case handling, and robotic palletization algorithms.

SYM stock has grown by 92.5% in the past year. In Q2 FY24 results, the Street expects Symbotic to post adjusted earnings of $0.02 per share on revenues of $411.23 million, showing a marked improvement to the loss made in the comparative quarter of the prior year.

Is SYM a Good Stock to Buy Today?

On TipRanks, SYM stock has a Strong Buy consensus rating based on nine Buy and two Hold recommendations. The average Symbotic price target of $53.44 implies 19.7% upside potential from current levels.

Key Takeaways

The AI wave is here to stay for a long time, and these 5 Best AI Stocks have the potential to benefit from it. Analysts favor these five stocks, citing the high growth potential of AI across sectors. Investors can consider these AI stocks to leverage the prospects in the fast-moving and innovative industry after thorough research.