These two Canadian dividend stocks are among the best stocks to buy, as per analysts. Investing in dividend stocks can be a great way for investors to earn regular income and stable returns. Dividend-paying companies generally have a sound financial background and high growth prospects, which enables them to continue paying dividends in the long run.

Let’s learn more about these Canadian companies that pay attractive dividends and have a Strong Buy consensus rating coupled with above 30% upside potential in the next twelve months.

Whitecap Resources (TSE:WCP)

Whitecap is a Canadian clean energy company that engages in the acquisition, development, and production of crude oil and natural gas. The company claims to be storing more carbon dioxide annually than it emits corporately.

WCP pays a regular monthly dividend of C$0.06 per share (C$0.73 per share annualized), reflecting a yield of 6.49%. To date, Whitecap Resources has paid C$1.9 billion in total shareholder dividends.

On April 24, Whitecap reported solid Q1 FY24 results, while also raising its Fiscal 2024 guidance. The company achieved a record production of 169,660 boe/d (barrels of oil equivalent per day). In Q1, WCP’s petroleum and natural gas sales, net of royalties remained more or less similar at C$787.7 million, mainly as averaged realized prices declined compared to the high prices seen in 2023. Looking ahead, WCP is guiding for production in the range of 167,000 to 172,000 boe/d.

Is Whitecap a Good Stock to Buy?

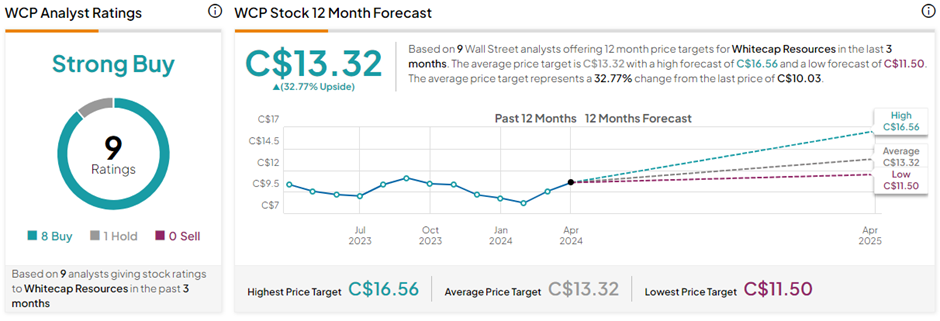

With eight Buys and one Hold rating, WCP stock has a Strong Buy consensus rating on TipRanks. The average Whitecap Resources price target of C$13.32 implies 32.8% upside potential from current levels. In the past year, WCP shares have gained 1.7%.

Northland Power Inc. (TSE:NPI)

Northland Power is an electricity producer dedicated to developing, building, owning, and operating clean and green global power infrastructure assets in Asia, Europe, Latin America, and North America.

NPI has consistently paid a monthly dividend of C$0.10 per share, reflecting an attractive yield of 5.52%.

Northland Power is set to release its Q1 FY24 results on May 15. The Street expects NPI to post diluted earnings of C$0.53 per share on revenue of C$696.56 million, showing considerable growth over the prior year. In Q1 FY23, NPI posted adjusted earnings of C$0.27 per share on revenue of C$621.72 million.

Is NPI a Good Stock to Buy?

With six unanimous Buy ratings, NPI stock commands a Strong Buy consensus rating on TipRanks. The average Northland Power price target of C$29.84 implies 39.6% upside potential from current levels. In the past year, NPI shares have lost 34.7%.

Ending Thoughts

Investors seeking regular income can consider the above two stocks to boost their portfolio returns. These two high yield dividend stocks have earned a very bullish view from analysts and are expected to offer an attractive upside over the next twelve months.