Ardelyx (NASDAQ:ARDX) is grabbing investors’ attention. The successful launch of two FDA-approved, first-in-class commercial products, IBSRELA® and XPHOZAH®, presents significant revenue opportunities. These factors have contributed to remarkable sales growth for the company, which recently reported favorable quarterly results exceeding expectations. The stock is up over 98% in the past six months, and further upside is possible. Investors looking for a commercial-stage biopharma stock with growth potential may find this a compelling option.

Ardelyx Has Two Top-Notch Treatments on the Market

Ardelyx is a biopharmaceutical firm that researches, develops, and commercializes treatments for gastrointestinal and cardiorenal diseases. The company’s flagship product is tenapanor, a novel type of phosphate absorption inhibitor, which has been approved for two indications. Tenapanor is currently in circulation under the brand name IBSRELA, treating irritable bowel syndrome with constipation (IBS-C). The market for the treatment of IBS-C is large (over $3.4 billion), and the company is on track to achieve roughly 10% market share, with eventual peak sales predictions of $1 billion.

The second approved use for tenapanor is in circulation under the brand name XPHOZAH, as the first and only FDA-approved phosphate absorption inhibitor to reduce serum phosphorus in adults with chronic kidney disease (CKD) on dialysis, roughly 550,000+ patients in the U.S.

The company’s pipeline of candidate treatments under development includes RDX013, a pre-clinical-stage potassium-lowering compound for the treatment of hyperkalemia, and RDX020, a novel approach to treating chronic metabolic acidosis, for which there are currently no approved treatments.

Ardelyx’s Recent Financial Results and Future Outlook

Ardelyx reported a strong financial performance in Q1, with results exceeding expectations. The company’s total revenue was $46.0 million, showing an impressive year-on-year growth of 303.7% from $11.4 million in the previous year. A breakdown of its revenue reveals that IBSRELA U.S. net product sales revenue was $28.4 million, up from $11.4 million in the same period of 2023. XPHOZAH U.S. net product sales brought in $15.2 million, having had no comparable revenue in the previous year.

The net loss for the quarter was -$26.5 million or -$0.11 per share, exceeding consensus expectations of -$0.15 per share and showing improvement over the -$26.8 million or -$0.13 per share recorded for the same period in 2023.

Ardelyx remains in a strong position with total cash, cash equivalents, and short-term investments of $202.6 million, increasing from the $184.3 million held at the end of 2023. In the first quarter of 2024, the company drew $49.8 million in net proceeds under its term loan with SLR Investment Corp.

What Is the Price Target for ARDX Stock?

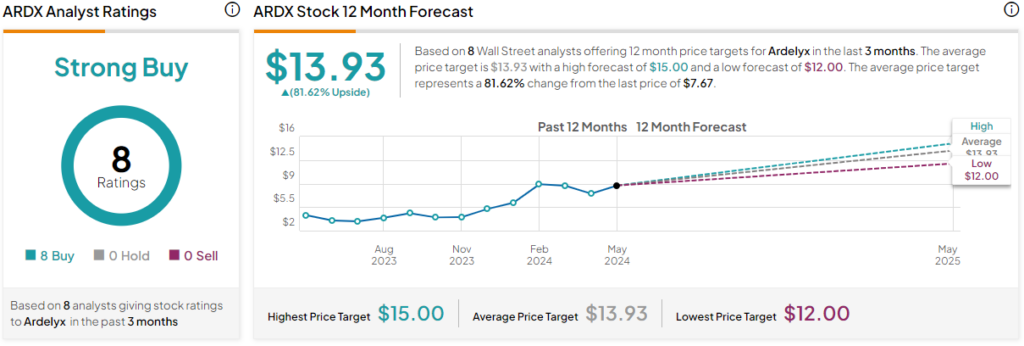

Analysts following the company have been quite bullish on the stock. For instance, TD Cowen analyst Joseph Thome recently raised the share price target from $11 to $12 while maintaining a Buy rating, citing strong revenue growth driven by higher-than-anticipated Xphozah sales.

Overall, Ardelyx is rated a Strong Buy based on the recommendations and 12-month price targets assigned by eight Wall Street analysts over the past three months. The average price target for ARDX stock is $13.93, which represents an 81.62% upside from current levels.

The stock has been trending upward, climbing over 13.6% in the past month. It trades toward the middle of its 52-week price range of $3.16-$10.13 and demonstrates upward price momentum, trading above the 20-day (7.60) and 50-day (7.57) moving averages.

Long-Term Revenue Growth Possible for Ardelyx

The company has done an excellent job bringing to market its lead drug with two FDA-approved treatment indications. IBSRELA is gaining market share, while XPHOZAH is in the initial ramp-up phase. This combination points to significant long-term revenue growth for the company. The stock shows positive momentum, and further good news (like another earnings beat in Q2) will likely catalyze the shares higher. The stock is an attractive candidate for investors looking for a biopharma company early in its commercial stage.